The more complex your business is, the less sense it makes to use cash accounting. Cash accounting doesn’t use accounts payable or accounts receivable, which can create confusion when dealing with a higher volume of business. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your accounts. Cash accounting recognizes revenue and expenses only when money changes hands, but accrual accounting recognizes revenue when it’s cash based accounting earned, and expenses when they’re billed (but not paid).

What is cash basis accounting? Definition and examples

With cash-based accounting, your income and expenses are recognized based on when you receive and make payments. With accrual accounting, your income is recognized when you earn it, regardless of whether you’ve been paid. Your expenses are also recognized when you incur them, even if you haven’t paid them yet. The IRS (Internal Revenue Service), for instance, requires businesses that have average annual gross receipts of more than $26 million in sales in the prior three tax years typically must use accrual accounting. The accounting method you choose matters, but how do you know which is best for your business? If you’re not an accountant yourself, it can be tricky to determine whether the cash or accrual accounting methods are better for https://www.bookstime.com/ you.

Accrual basis

- The AI algorithm continuously learns through a feedback loop which, in turn, reduces false anomalies.

- This method doesn’t track outstanding invoices or debts, potentially leading to cash flow mismanagement if not monitored carefully.

- Pretty much any form of payment/current assets, as long as it is reflected as positive income in your statements at the time of receival.

- Specifically, it focuses on when money is received, or expenses get paid, which may not occur exactly when these items are accrued.

- Accrual accounting is ideal for scaling companies that need to manage accounts payable, receivable, and financial reporting under accepted accounting principles.

- They can also maintain the records accurately using the chosen accounting method, ensuring smooth financial reporting.

- Due to this, publicly traded companies don’t use the cash basis accounting method.

Consulting with a financial professional can provide valuable insights and advice tailored to your specific business needs. A professional can help navigate the complexities of financial management, ensure compliance with accounting standards and tax laws, and aid in transitioning to other accounting methods if and when necessary. By considering these adjustments and the implications of cash basis accounting, businesses can maintain accurate records and manage their financial and tax positions effectively. These practices help in ensuring that the financial statements reflect a true picture of the company’s cash flow situation and aid in strategic financial planning.

Personal Service Corporation (PSC)

If you’re searching for accounting software that’s user-friendly, full of smart features, and scales with your business, Quickbooks is a great option. The cash method can be done with a simple single-entry system, so a complex accounting program is not always necessary. Month-end bank reconciliations should be easier when you are not booking accruals. However, single entry systems also have drawbacks, which are outlined below. Clio’s software helps law firms streamline many accounting and finance tasks, including trust accounting needs, and makes it easier for clients to pay you. Let’s say you complete legal work for a client and invoice the client in January, but the client doesn’t pay until March.

- You can take a current deduction for vacation pay earned by your employees if you pay it during the year or, if the amount is vested, within 2½ months after the end of the year.

- Accrual accounting recognizes income and expenses when they occur, regardless of whether the money has actually been received or paid out.

- As such, it’s challenging to get a long-term picture of financial health.

- BILL Spend & Expense can help you take control of your budget and start spending smarter with customizable spending controls and policies.

- Whether you’re working with a CPA, using an accounting software, or just keeping the books yourself, tax law requires you to choose one method of accounting and to stick to it for the fiscal year.

Application Management

- When filing their taxes, the small business might use the cash basis, but use accrual accounting internally to track inventory, giving the owner a more complete picture of the business’s profitability.

- These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”).

- If you work with an accountant, you can easily share your spreadsheets to provide an accurate look at your finances and tax obligations.

- If you value simplicity in accounting, this method can be a lifesaver (especially if you don’t have a ton of accounting knowledge).

- Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development.

- While the hybrid method does give a more complete picture of profitability, it is complex.

- An accrual-based system may better meet your needs if you have inventory, accounts payable, or need more detailed financial information.

A small service business, for example, may be fine with a straightforward cash accounting system. Meanwhile, a car dealership generally must track inventory to accurately reflect business net income. A larger, growing business may need more comprehensive reporting on the accrual method. No matter which method you choose, any major accounting software can help you keep accurate records for all your reporting needs. In cash basis accounting, revenue is recorded only Statement of Comprehensive Income when cash is actually received. A business recognizes income at the moment payment is collected, regardless of when the product or service was delivered.

When considering cash basis accounting, think about how stable and steady your income flows are, as this will have a major impact on whether this method makes sense for you. If you’re not yet sure whether cash vs accrual accounting is best for your business, remember it all boils down to how you operate. When it comes down to it, the accounting method you choose has to do with the size and complexity of your business.

How Matt Passed the CPA Exams in 5 Months with No Accounting Experience

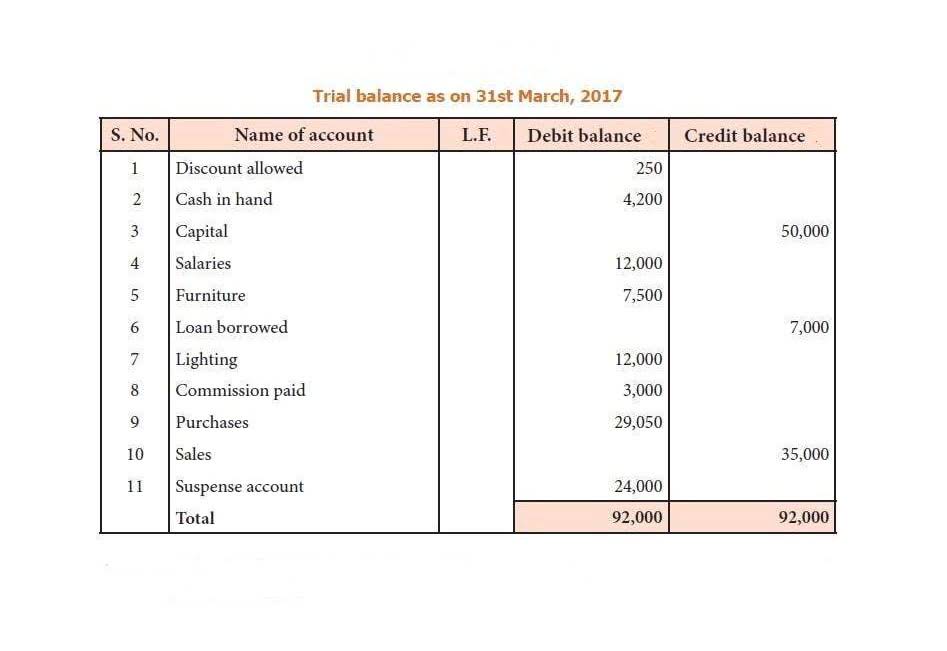

Financial statements reflect the accurate financial health due to the inclusion of AR and AP accounts. Cash basis accounting is when you only record transactions when the money enters or leaves your business, even if they were earned or billed earlier. The below mentioned excel shows how to do cash basis accounting in case of a small business. Let’s consider a small business example to illustrate how cash basis accounting works in practice. Find out everything you need to know about cash basis accounting, the pros and cons, and how it works in practice. Note that the net income from the income statement carries over to the cash flow statement, and the cash at the end of the year on the cash flow statement matches the cash figure on the balance sheet.